Given Tasmania’s commitment to renewable energy, it is unsurprising that the state embraces solar power. It is an investment in the environment, saves money on bills, and the rebate offers up to 30 per cent discount on solar costs. Incentives from the Government to encourage solar power systems and rebates make solar installations more affordable. We look closer at the solar rebate in Tasmania and explain the savings incentives and eligibility for a solar rebate.

What Is A Solar Rebate?

The solar rebate is an amount of money you get refunded for having solar panels installed. As a reward for installing solar panels with renewable energy certificates, your solar installer can use the solar rebate to discount installation and system costs. Basically, it makes solar panels cheaper to buy and install.

Solar Rebates in Tasmania

There is one solar rebate currently available in Tasmania: a Federal Government initiative of renewable energy certificates called Small scale technology certificates (STCs). When you install an eligible solar system, you can receive a rebate by claiming these STCs within the deeming period. Each STC has a value, with one STC given for every 1MWh your system produces. The amount of STCs created depends on the state and the size of the unit installed. Basically, the more STCs, the higher the rebate.

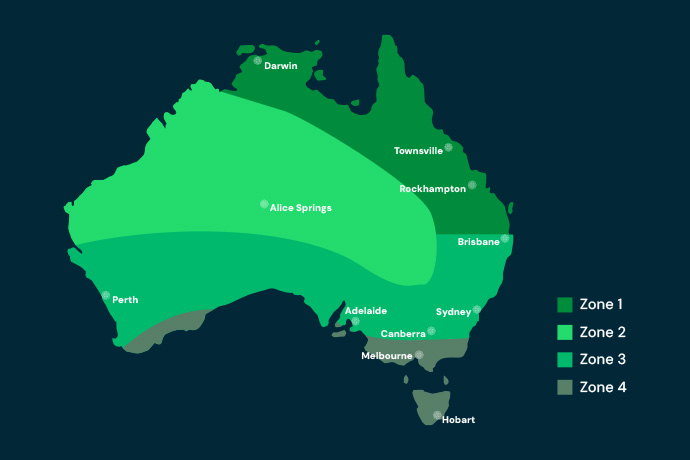

The STC value is defined by zones and each state falls under a particular zone. There are zones 1,2,3 and 4, with zone 1 giving the highest rebate, and zone 4 the least. Tasmania is categorised in zone 4 and thus receives a lower number of STCs than some other states.

How STCs Are Calculated

The number of STCs are directly linked to the size of the solar system installed. A larger solar system has a higher number than a smaller one. The more STCs your solar panels are eligible for, the higher the value of your rebate. The current STC price is valued at approximately $38 each but, as these are traded on the open market, fluctuations can occur. The table below shows the solar system size and corresponding rebates according to an estimated price of $38.

| Number of panels | STC Quantity | STC Value |

| 6 | 21 | $798 |

| 7 | 25 | $950 |

| 8 | 29 | $1102 |

| 9 | 32 | $1216 |

| 10 | 36 | $1368 |

| 11 | 40 | $1520 |

| 12 | 43 | $1634 |

| 13 | 47 | $1786 |

| 14 | 51 | $1938 |

| 15 | 54 | $2052 |

| 16 | 58 | $2204 |

| 17 | 62 | $2356 |

| 18 | 65 | $2470 |

| 19 | 69 | $2622 |

| 20 | 72 | $2736 |

| 21 | 76 | $2888 |

| 22 | 80 | $3040 |

| 23 | 83 | $3154 |

| 24 | 87 | $3306 |

| 25 | 91 | $3458 |

| 26 | 94 | $3572 |

| 27 | 98 | $3724 |

| 28 | 102 | $3876 |

| 29 | 105 | $3990 |

| 30 | 109 | $4142 |

| 31 | 113 | $4294 |

| 32 | 116 | $4408 |

| 33 | 120 | $4560 |

| 34 | 124 | $4712 |

| 35 | 127 | $4826 |

| 36 | 131 | $4978 |

| 37 | 135 | $5130 |

| 38 | 138 | $5244 |

| 39 | 142 | $5396 |

| 40 | 145 | $5510 |

| 41 | 149 | $5662 |

| 42 | 153 | $5814 |

| 43 | 156 | $5928 |

| 44 | 160 | $6080 |

| 45 | 164 | $6232 |

| 46 | 167 | $6346 |

| 47 | 171 | $6498 |

| 48 | 175 | $6650 |

| 49 | 178 | $6794 |

| 50 | 182 | $6916 |

| 51 | 186 | $7068 |

| 52 | 189 | $7182 |

| 53 | 193 | $7334 |

| 54 | 197 | $7486 |

| 55 | 200 | $7600 |

| 56 | 204 | $7752 |

| 57 | 208 | $7904 |

| 58 | 211 | $8018 |

| 59 | 215 | $8170 |

| 60 | 218 | $8284 |

Factors Affecting STC Calculation

Three factors that directly impact STC calculation are unit size, zone rating and deeming period. We explain each here and what it means for a rebate.

- Size of the solar system. The size of the solar system unit installed will affect the rebate calculation. The rebate is paid per kW of power so a larger system will naturally get more STCs and a higher rebate. The more renewable energy your solar system is capable of producing, the higher the financial return.

- Zone rating. The zone rating is determined by the amount of solar energy potentially produced in different areas. Areas like Darwin and parts of Queensland have more sunlight during the day and, therefore, higher renewable resources for electricity, and so are zoned category 1. Whereas Tasmania and Victoria have less sunlight, so fall under Zone 4. The zones determine the amount of certificates per kW. The more certificates, the higher the rebate.

- Deeming period. The deeming period is the renewable energy created from the time the solar unit is installed up until 2030, when the STC system is due to be phased out. The deeming period affects the STC calculation as each year that passes in this period, the amount of certificates decreases by 1.

Eligibility for Solar Rebate Tasmania

When contemplating installing a solar unit, it is important to know the rebate eligibility requirements, as this may influence the price and the type of unit you choose. To be eligible for the solar rebate in Tasmania, these criteria must be met.

- Small Generation Unit (SGU) prerequisites. The system must qualify as an SGU, which refers to small-scale solar, wind and hydro systems. To qualify as an SGU, the system can only have a maximum size of 100 kW capacity.

- Minimum size capacity. The system must have a minimum size of 2.5kW capacity.

- Approved installation. The system must be installed by a Solar Australia Accreditation (SAA) -accredited solar installer.

- Approved components. The system’s components need to be SAA-approved.

- Compliance with regulations and standards. The system must pass Australian and NZ standards, comply with regulations of local and Government bodies.

- Installation complete. The system must be installed and operational before the rebate can be claimed.

- Application deadline. You must apply for the rebate within three months of installation.

- Proof of purchase. On your application, you must provide proof of purchase and installation.

- One system eligibility. Only one system per premises is eligible for the solar rebate.

How To Apply for a Solar Rebate STC in Tasmania

You can apply for the solar rebate STCs yourself or assign them to a registered agent for an upfront discount on the installation of solar panels. It is a good idea to chat with your solar installer before the installation begins to help understand costs and the number of STCs you might be eligible for.

You can also discuss whether you want to nominate your installer as the registered agent to claim them or if you decide to claim them yourself. Many people opt to use their rebate eligibility in the form of an upfront discount from the installer. However, you can also create your own STCs and sell them, as they are a valuable commodity worth trading on the open market. Whether you are registering as an agent or a system owner, the process to apply for solar rebate STCs is as follows.

- Make sure the system is eligible for STCs. Check the deeming period and calculate how many certificates your system should receive.

- Have proof of identity that you are the owner of the system, or assigned registered agent.

- Make sure there are no other STCs applied for on the new system.

- Make sure all contracts and documents are signed by the installer, owner, and retailer.

- Go online to the REC Registry (the registry that creates the renewable energy certificates).

- Create a registered account. If you are the system owner, create an account under “registered person”. If you are an agent, create an account under “registered agent”. Apply for the certificates via this platform. If creating an account as a “registered person”, or “registered agent”, you must provide proof of identity, provide a legal name for the account, and follow the eligibility requirements for the REC Registry account. Registered agents also need to complete the SRES Smart modules (established to help agents understand responsibilities and standards of practice).

- Pay the registration fee. STC applications are liable for a fee. If applying as a registered person, the fee is $20. If applying as a registered agent, the one-time registration fee is $230.

Mistakes to Avoid When Claiming Solar Rebate STC

Making mistakes on your STC application is likely to impact the success of your rebate claim. Check out our list of things to avoid when claiming your solar rebate.

- Miscalculating STC rebates. It is imperative you calculate correctly the number of rebates you qualify for. Use an online STC rebate calculator to make sure you have the correct figures. If you are a personal agent, This is extremely important as you will be selling your certificates yourself.

- Providing limited or incorrect information. When submitting the STC application online, make sure you have all the correct details and that all the fields are filled out correctly. This will include precise information like address, size of the solar unit, the solar company, installers and identity verification.

- Missing the deadline. All applications must be submitted within 30 days of the date of installation. If you miss the deadline, you may find the application is not considered.

- Using an unqualified installer. To be eligible for the STCs, the installer must be qualified under the Clean Energy Council guidelines. If your solar system is installed by an unqualified installer, you will not be eligible for a rebate.

Tasmanians can save thousands of dollars with the help of solar rebates through the Federal Government’s STC scheme. As a state that prides itself on a reputation of renewable living, solar energy is becoming more popular and affordable. Our guide on solar energy rebates explains what rebates are available, how they are calculated and how to apply for them when installing your solar panels. For any further information on solar panels and installation in Tasmania, give the expert team at TSS a call.